…The Simple Secret to a Tax-Free $500,000 (Yes, Really!)”

You Own a Home? Great. You Might Be Sitting on Tax-Free Money.

Most people who own homes have no idea about this.

It’s called Section 121 of the IRS tax code. And if you understand it — even just the basics — it can save you hundreds of thousands of dollars in taxes.

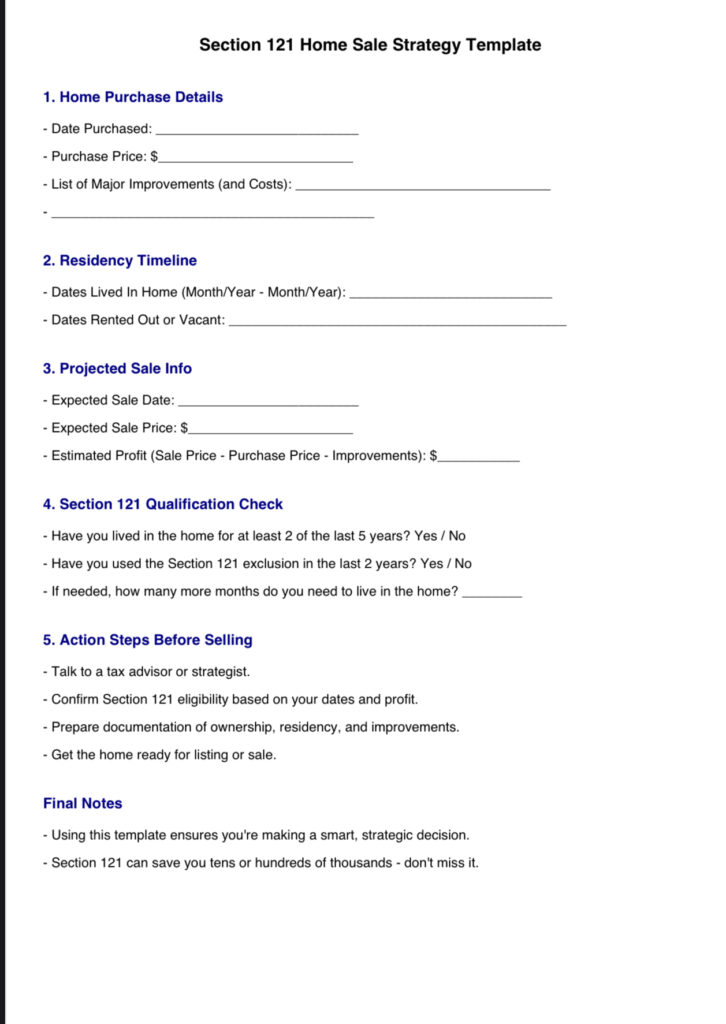

Section_121_Home_Sale_Strategy_Template

We’re not talking tricks or loopholes. This is 100% legal, IRS-approved, and powerful.

And best of all: it’s simple.

What is Section 121?

Here’s the deal:

If you sell your home and you made a profit, normally you’d have to pay capital gains tax on that profit.

BUT — if you qualify under Section 121, you can avoid paying any taxes on a big chunk of that profit.

The Rules (Keep it simple):

- You must have owned the home for at least 2 years

- You must have lived in the home for at least 2 out of the last 5 years

- The 2 years do not have to be in a row

- The home must be your primary residence during those 2 years

If you meet those two simple conditions, here’s what you get:

- If you’re single: you can make up to $250,000 in profit — tax free

- If you’re married filing jointly: you can make up to $500,000 in profit — tax free

Real-World Example (Totally Real Story):

A couple bought a home for $300,000. Years later, they could sell it for $700,000.

That’s a $400,000 profit.

At first, they had lived in the house for 1 year, then rented it out for 2 years. If they sold it right then, they would have owed taxes on most of that $400,000.

But someone told them about Section 121.

So they moved back into the house for 2 more years.

Now they’ve lived in the house 2 of the last 5 years — and they’re married.

When they finally sold it, that $400,000 in profit was 100% tax-free.

They kept every penny. The IRS got zero.

How This Could Be Worth Six Figures (Even If It’s Not Overnight)

This isn’t a “get-rich-today” strategy.

But it is a “get-rich-smart” strategy.

If you:

- Buy a home

- Live in it at least 2 years

- Wait for the value to rise

- Sell it tax-free

- Do this more than once…

You could save hundreds of thousands in taxes over your lifetime.

That’s money you can reinvest, use to buy your next property, or simply keep in your pocket.

Six figures saved = six figures earned.

Don’t Make These Common Mistakes:

- Selling your house too early, before meeting the 2-year requirement

- Renting your house out too long and missing the 2-out-of-5-year window

- Thinking you need to live there for 5 years in a row (you don’t!)

- Not knowing you can move back into your house before selling to qualify

- Relying on a CPA who only “files taxes” and doesn’t strategize

Checklist: How to Use Section 121 Like a Pro

Use this quick checklist to see if you qualify for the tax-free profit:

Do You Qualify?

- I owned the home for at least 2 years

- I lived in the home for at least 2 of the last 5 years

- I’m selling the home for more than I bought it

- I haven’t used the Section 121 exclusion on another home in the last 2 years

Planning to Sell Soon?

- I’ve calculated how much profit I’ll make

- I know how much of that profit will be tax-free

- I’m timing my move/sale to make sure I qualify

- I’ve spoken with a tax strategist (not just a tax preparer)

Bonus Tips: Extra Info You Should Know

- You can only use this exclusion once every 2 years

- If you’re in the military or certain government jobs, you may qualify for special extensions

- If you were forced to sell early (because of job change, health issues, etc.), you may still get a partial exclusion

- The rule only applies to your primary residence, not investment or vacation homes

Final Thought: You Didn’t Know, But Now You Do

This isn’t about complicated tax jargon. It’s about keeping what’s yours.

If you’ve been paying into your home — building equity, paying taxes, doing maintenance — you deserve to reap the full reward when it’s time to sell.

Section 121 helps you do just that.

Need a Pro to Walk You Through It?

If your CPA never mentioned this, you’re not alone.

But now you know.

Want help with the details, timing, or planning?

Drop the word “advisor” below or click here to connect with our tax strategy team.

Let’s make sure the next time you sell your home, you keep every dollar you deserve.

I would like to add that if you need a tax accountant, please contact Carter Cofield, CPA. This gentleman. is amazing and has a great team that will help you.

Discover more from UnF🍸ckable

Subscribe to get the latest posts sent to your email.